RCLCO’s Mid-Year 2020 Sentiment Survey on Real Estate Dismal, But…

A 17 page sentiment survey of a highly experienced pool of real estate professionals from across the country and across the industry has just been released by RCLCO (formerly Robert Charles Lesser & Co.) Real Estate Advisors. Called “RCLCO’s Mid-Year 2020 Sentiment Survey,” approximately two-thirds (68%) of respondents who took the survey have worked in the real estate industry for 20 years or more, and 85% of respondents are C-suite or senior executives in their organizations.

Brad Hunter, Managing Director at RCLCO said “This isn’t a ‘cycle’ that we’re in — it was a sudden stop. Many sectors of real estate leapfrogged entire stages of the normal real estate cycle and went straight to the bottom. The good part about that is, as they say, you can’t fall off the floor. The real estate executives and developers that responded in this survey feel that the worst is behind us, at least for many sectors of real estate.”

RCLCO’s mission is to help our clients make strategic, effective, and enduring decisions about real estate, with more than 50 years of providing analytics, actionable advice, and customer service.

Some of the key takeaways from the survey included:

- Industry leaders see the severe declines as being behind us, but some sectors still face a moderate downside.

- Only a relatively small percentage (less than 16%) believe the markets will be significantly worse over the next 12 months.

- The pandemic has provided a boost to the industrial space market due to increased demand for deliveries during lockdowns.

- Not surprisingly, the mid-year RMI showed an absolute free fall to the bottom. Of note, certain sectors, including hotels, are expected to begin recovery within the next twelve months.

- The office market is still seen in decline, and there are varying opinions among participants as to the chances of recovery within the next year, reflecting uncertainties about the economy and the durability of the work-from-home trend.

The report uses charts and graphs to emphasize the findings, giving a historical point of view to the positioning statements.

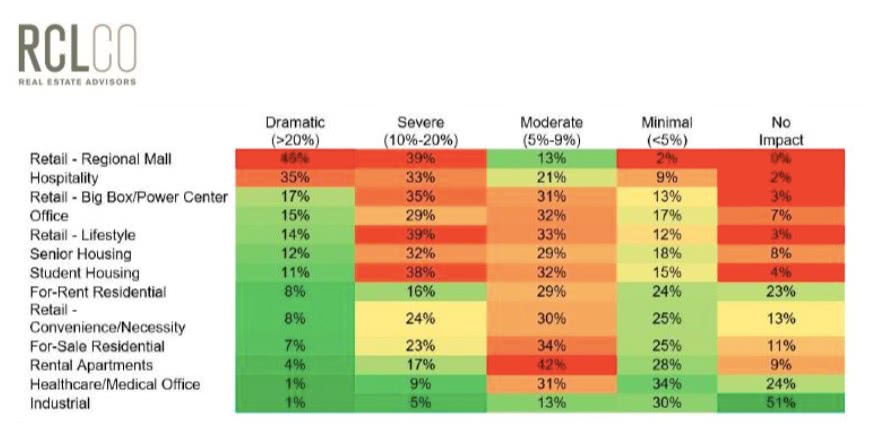

The chart above summarizes how respondents viewed the impact of COVID and how it would play out across various sectors of the real estate market; the sectors that they expect to be most impacted are Retail-Regional Malls, Hospitality, and Big Box Retail. The sectors they expect to suffer minimal impact include Industrial, Healthcare/Medical and Rental Apartments. The report covers all these markets and includes a comprehensive feedback from survey participants on the conditions faced by companies in the coming months.

According to the report, the results are generally “in line with our experience from our consulting work, in which projects are being held to tougher underwriting standards, but the good projects are getting funded.” The authors — Brad Hunter, Managing Director, Charlie Hewlett, Managing Director, and Grace Amoh, Associate – note that ion just the last few weeks, the company has learned that transaction volume in the multifamily rental sector (which had dropped to nearly zero in the early stages of the pandemic), “is starting to make a strong comeback, and that many of the deals that had been pulled from the market in Q1 and Q2 2020 are likely to come back to the market in H2 2020, with very little, and for some of the best assets no, repricing.”

Founded in 1967 and formerly known as Robert Charles Lesser & Co, RCLCO today is considered one of the nation’s leading and most trusted real estate advisors. Their mission is to help clients make strategic, effective, and enduring decisions about real estate. Since its formation, RCLCO has been serving the best minds in real estate with cutting-edge analytics and actionable advice.